We’re Voting for the Fair Tax

Tuesday is Election Day. CLICK HERE TO FIND OUT WHERE TO VOTE.

SEIU Healthcare Illinois members are voting YES for the Fair Tax on Tuesday, November 3rd.

What’s a Fair Tax?

A Fair Tax means working families pay less, the rich pay their fair share, and we invest in quality care, quality jobs, and the services we all deserve. A Fair Tax can help move us closer to racial, social, and economic justice.

It is an income tax in which families with lower incomes pay lower rates and families with higher incomes pays higher rates.

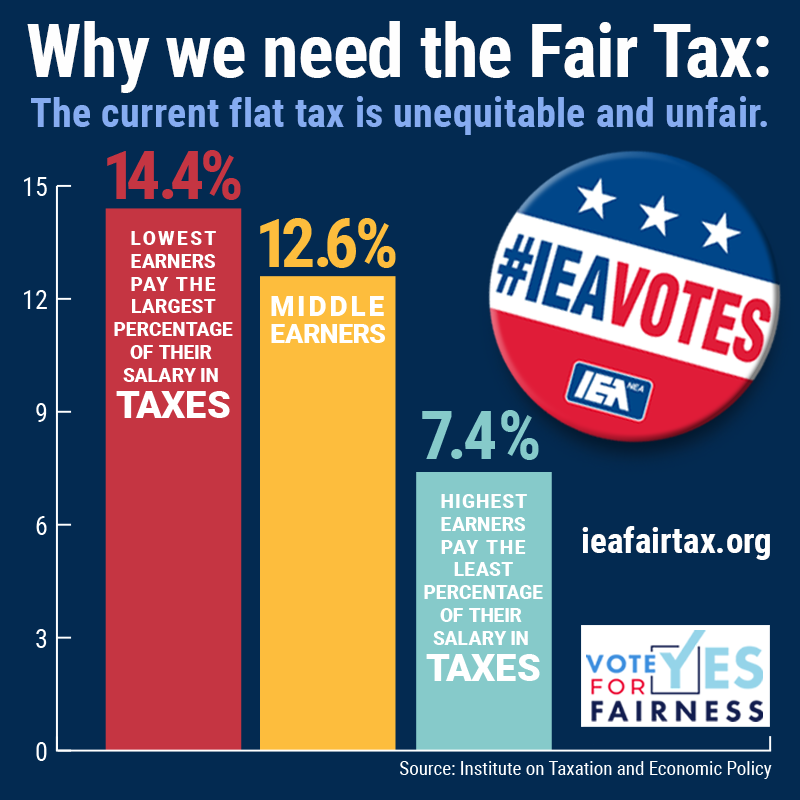

WHAT WE HAVE NOW:

A broken, unfair system.

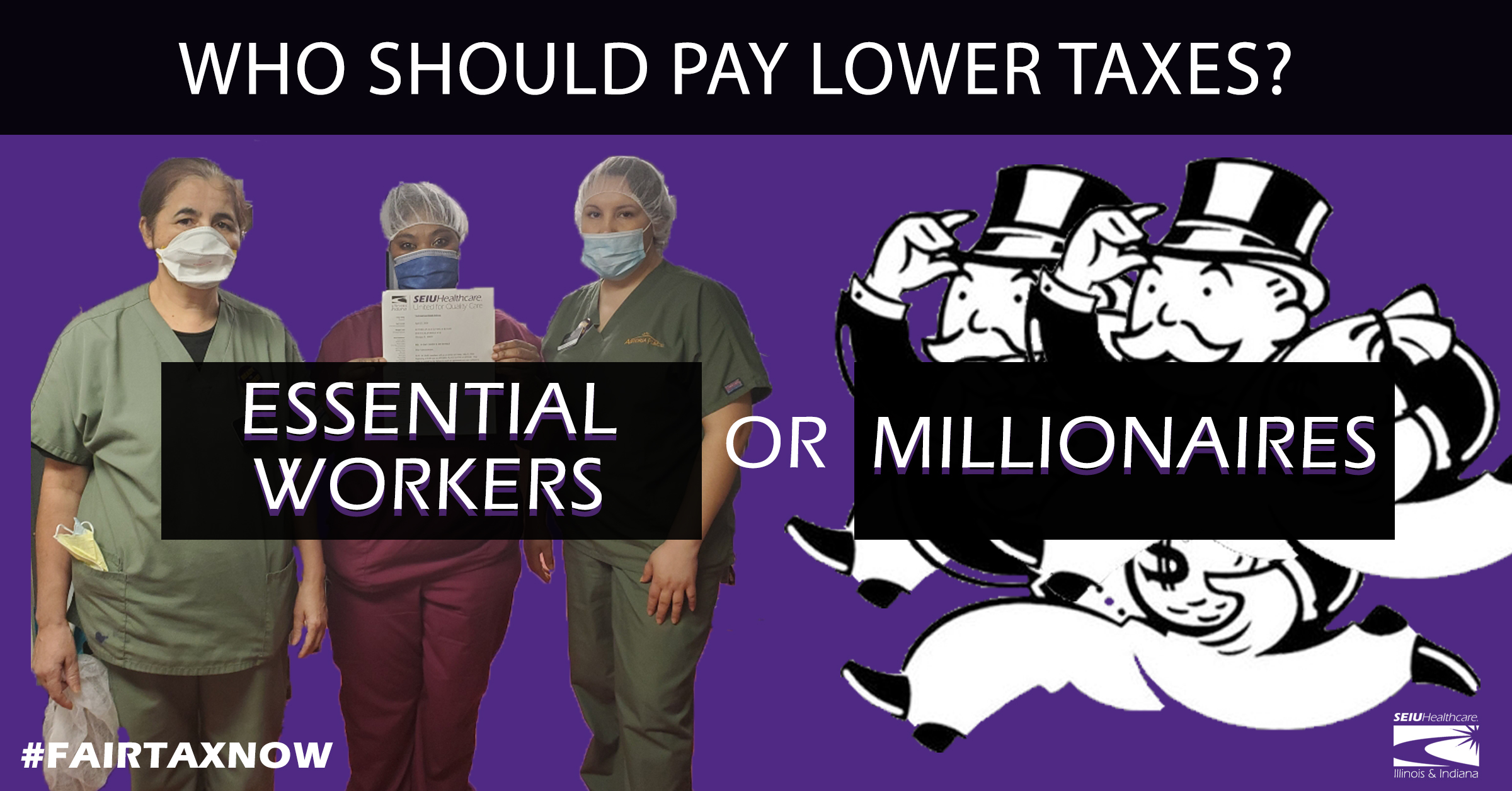

Millionaires pay a lower percentage of their income for state and local taxes than minimum wage workers! That ain’t right.

Our current tax system is unfair and inadequate. It has burdened working families with funding our State’s most critical services, leaving the rich off the hook to take advantage of tax loopholes and acquire historic levels of wealth and profit.

WHAT WE DESERVE:

We need a Fair Tax so our kids grow up safe and sound and that our seniors grow old with dignity and independence. No matter where we were born or what we look like, we deserve to have the resources we need to live free and to have real choices. We deserve to be healthy, safe, and secure.

IN NOVEMBER CHANGE IS GOING TO COME:

https://youtu.be/GvC-zIkgNQY

This November, Illinois voters and members of SEIU Healthcare IL will have the opportunity to cast their vote to transform the broken tax system in Illinois that currently forces working families to pay twice as much of their share in taxes than the wealthy.

- A Fair Tax is an income tax in which families with lower incomes pay lower rates and families with higher incomes pays higher rates.

- Every Illinois family who makes under $250,000 – 97% of families – gets a tax cut under the Fair Tax. Find out what you’ll pay under a Fair Tax here.

- SEIU Healthcare members believe in quality care, quality jobs, and equity. For too long, families and communities all across Illinois – Black, Brown, Asian, and White – have been denied investments they deserve. The Fair Tax Plan will provide $3.4 billion a year in revenue to help provide good care and good jobs as well as help reverse effects of decades of structural racism. Click here for some examples of how we could expand services under a Fair Tax.

Voting Information

Make sure you’re ready on November 3rd!

Click here to learn about when, where, and how to vote for the Fair Tax in Illinois.

Where’s the Fair Tax on the Ballot?

At the top!

Official Ballot Language

The Fair Tax Amendment will be the first item on the ballot. Don’t skip it! VOTE YES!

It will read…

Proposed Amendment to the 1970 Illinois Constitution

Explanation of Amendment

The proposed amendment grants the State authority to impose higher income tax rates on higher income levels, which is how the federal government and a majority of other states do it. The amendment would remove the portion of the Revenue Article of the Illinois Constitution that is sometimes referred to as the “flat tax,” that requires all taxes on income to be at the same rate. The amendment does not itself change tax rates. It gives the State the ability to impose higher tax rates on those with higher income levels and lower income tax rates on those with middle or lower income levels. You are asked to decide whether the proposed amendment should become a part of the Illinois Constitution.

[Y/N]

The Current System is Unfair

Millionaires pay a lower percentage of their income for state and local taxes than minimum wage workers! That’s not fair!

The old flat tax system is unfair and inadequate. It has burdened working families with funding our State’s most critical services, leaving the rich off the hook to take advantage of tax loopholes and acquire historic levels of wealth and profit. The federal government and majority of States in the US no longer use the flat tax.

How much will you pay under a Fair Tax?

Every family who makes under $250,000 – 97% of Illinois families – gets a tax cut under the Fair Tax. Click the image below to see how much you’ll pay under a Fair Tax.

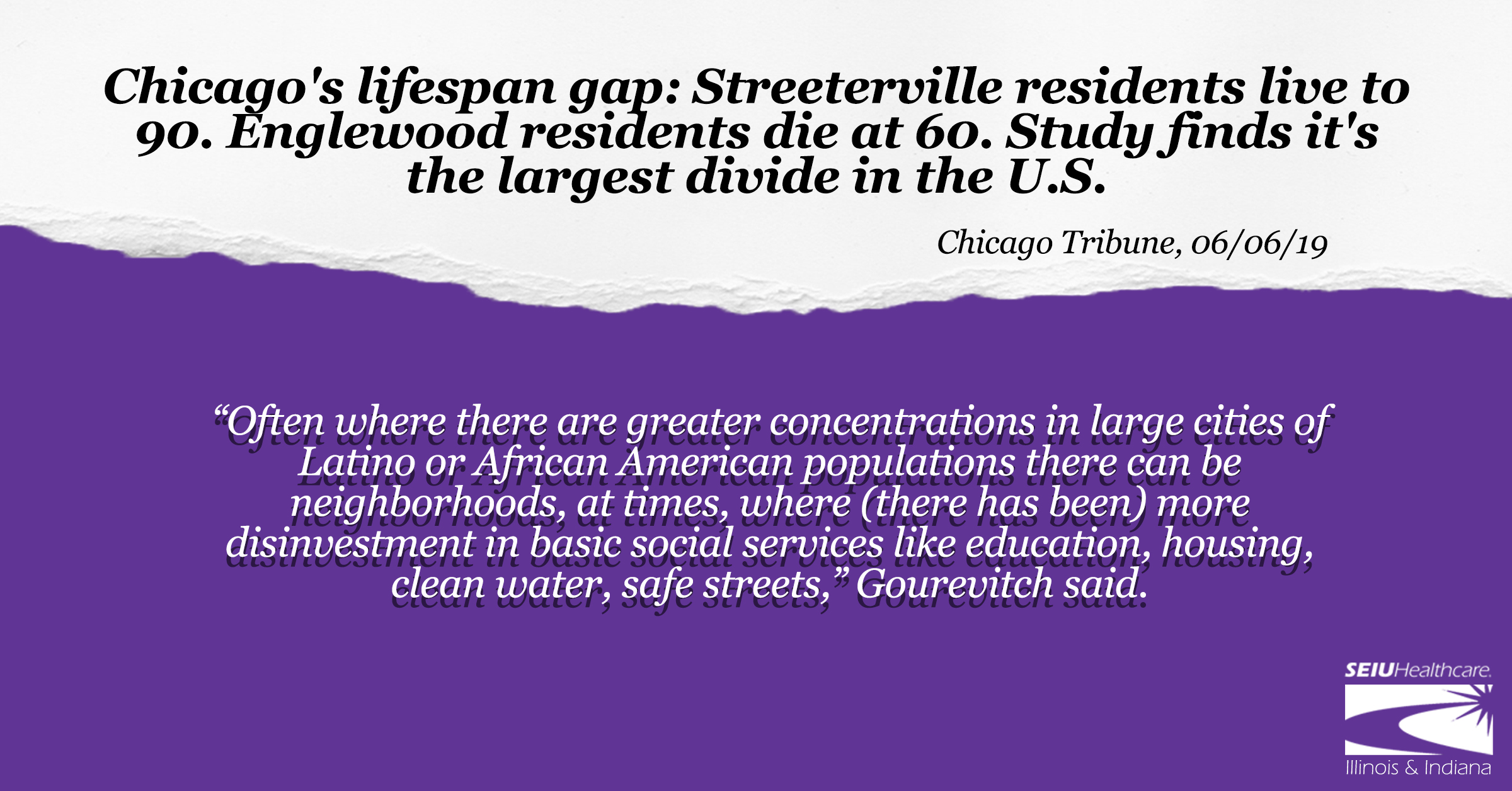

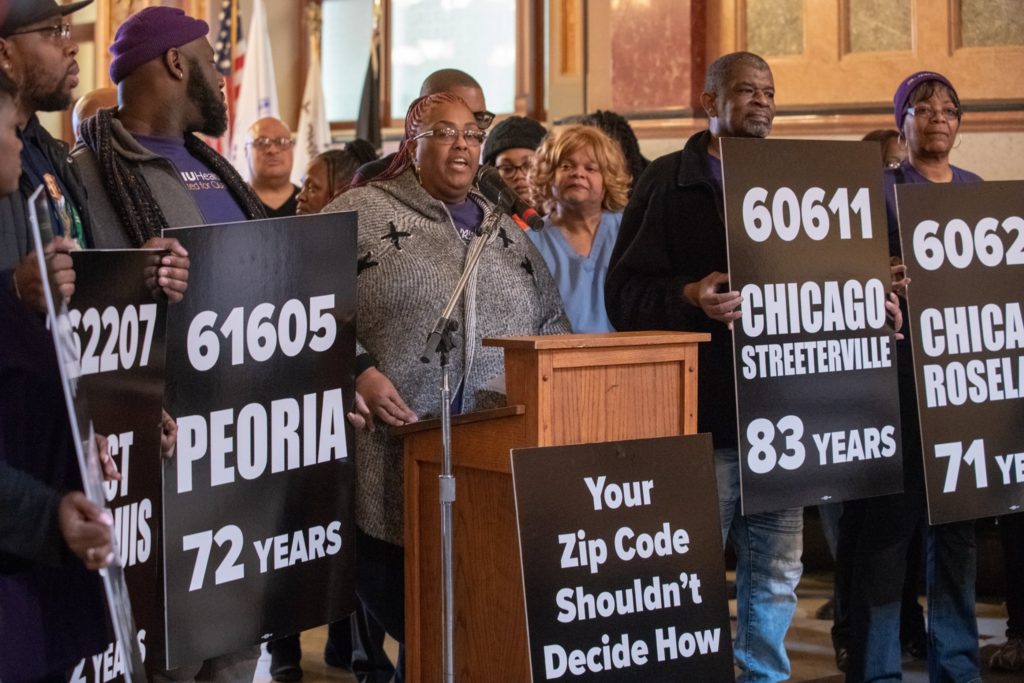

The Crisis Started Long Ago

Budget deficits at every level of government across Illinois have forced harmful cuts to education, human services, health care, infrastructure, public safety, and jobs, disproportionately impacting communities of color and those who most rely on critical services like seniors, children and people with disabilities.

Before the COVID crisis, many of us – Black, Brown, Asian, White – were already just one paycheck away from losing it all. A little bad luck could mean we lose our housing, our healthcare, and our child care.

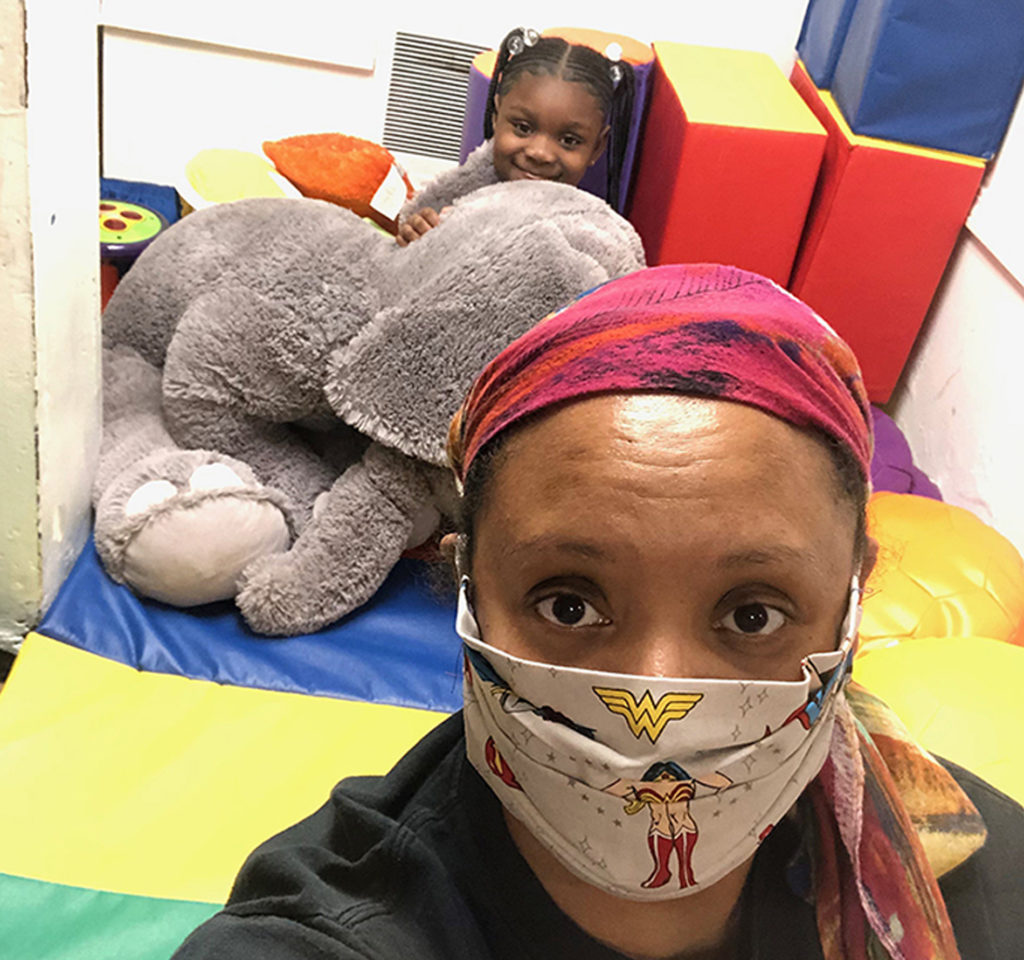

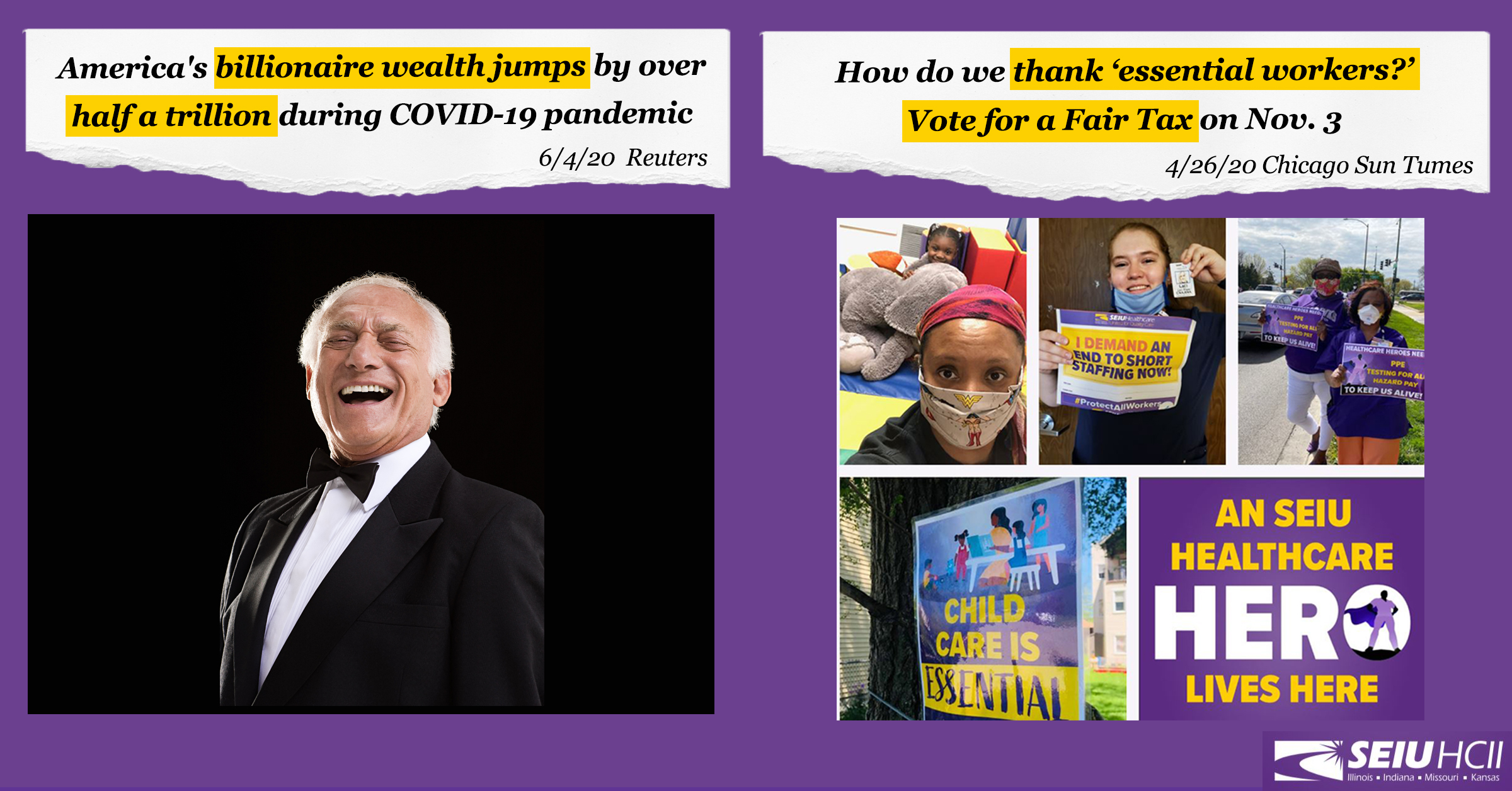

We Are Essential. We Should Be Treated As Such.

During this crisis, Illinois has relied on us to overcome the pandemic – not the millionaires. It is working class people on the front lines combating COVID-19 in hospitals and nursing homes, caring for the children of essential workers, and providing vital home care services for the elderly and people with disabilities.

It’s Time for the Rich to Pay Their Fair Share

We, who have borne the burden of the current taxing system, now bear the brunt of this public health crisis. It is time the millionaires and billionaires carry their weight by paying their fair share of taxes.

We Deserve Racial, Social, & Economic Justice

With a Fair Tax, we will have more resources to pay essential workers and invest in communities, especially black and brown communities that have been neglected.

Here are some facts:

- Women are paid at least 20% less than men

- African-American women are paid about 37% less than white men

- Latinas are paid about 45% less than white men

Many politicians, especially in the past, have held sexist and racist attitudes and policies have put women and people of color in a deep hole which compounds over time. The lack of investment in black and brown communities has been deadly.

Governor Pritzker’s Fair Tax plan will provide $3.4 billion per year in additional revenue to fund vital state services so we can correct these injustices.

When women and people of color can have affordable child care, affordable housing, home care for their loved ones, and get a decent wage, they can start to gain wealth and have security for their families.

These services that the Fair Tax can help fund will help all workers & communities – White, Brown, Black, & Asian – throughout Illinois.

We Deserve a Better Future

We need a Fair Tax so our kids grow up safe and sound and that our seniors grow old with dignity and independence. No matter where we were born or what we look like, we deserve to have the resources to have the freedom to live the lives of our choosing. We deserve to be healthy, safe, and secure.

Find out where and when to vote and where the Fair Tax Amendment is on your ballot: https://seiuhcilin.org/resources/election-information/#fairtax

What a Better Future Might Look Like

Quality care, Quality jobs, and Equity

The Fair Tax is estimated to provide $3.4 billion a year in funding for important services and jobs.

Many More Seniors with Home Care

100,000 more seniors could be served by the Community Care Program, almost doubling its size ($1.1 billion)

Many More Families with Child Care

100,000 more children could receive affordable child care through CCAP ($630 million)

Safe Staffing at Nursing Homes

Every CNA in the state to have a 1 to 5 resident ratio at all times ($980 million)

Funding for Safety Net Hospitals and Charity Care

$50 million more in funding to each safety net hospital in the state: ($1 billion)

Covering the cost of charity care hospitals provide in a year, serving nearly 1 million patients ($805 million)

Help for Immigrant Communities

Some immigrant services are very inexpensive, yet have a big return on investment. For example, we spend less than $7 million on immigration welcoming services. So a Fair Tax could easily help our immigrant communities.

Investment in Black & Brown Communities

No matter where we live or where we came from, we deserve quality care and quality jobs. With a Fair Tax, we will have more resources to pay essential workers – most of whom are black and brown women – and to reinvest in communities that have long been neglected, including many black and brown communities that have been the hardest hit.

Find out when and how to vote and where to find the Fair Tax amendment on the ballot.